I understand a lot more now. A lot of thanks to @sirajraval who does amazing in-depth videos about all kinds of applied computer science things.

I am not a .. whatever the words are. Advice-giver-fundy-wundy-thingy-wingy. I’m just a guy. If you things you’re getting advice in me, you’ll probably loose money on those bets. ![]()

I think the Idea of cryptocurrency is great. There’s definitely a need for a mathematical, un-corrupt-able middle man know as Math. Something along the lines of “We can all agree this is the truth, that this ledger is accurate”, something that cannot be fudged.

Note that in these screenshots, I have not masked any of the amounts. Yo, this is chump change guys. I spend more on coffee. I can’t help it that BTC went up 75x making it valuable.

Inventory

First, an Inventory of various Crypto Currencies of various flavors .. these are the ones I’ve been interested in.

- I think Bitcoin (BTC), while famous, is not going to be the long term winning solution.

- But because its famous, people are throwing themselves at it

- Which causes it to bounce all over the place

- Which excites lots of other people

- Which causes it to bounce even more

- It can only handle so many transactions per second

- Lots of people want to transact in it

- Which leads to really large transaction fees (you have to volunteer in to a large transaction fee or your transaction gets ignored in favor of others who volunteered a large transaction fee).

- I was moving BTC over to my hardware wallet, the fee was $35 at the time, regardless of how much I moved.

- There’s plenty of supply left

- There’s plenty of people in the world, ie, untapped demand, left

- So its going to bounce around a while longer I think. As long as there are curious people out there.

- Will likely get relegated to “how to move large sums of money around” more than “small transactions” just because of the upscaling of transaction fees.

- There’s Ethereum as well (ETH)

- Its ability to do contracts .. ie, programming .. ie, stuff like giving somebody a loan, getting back payments, and calculating here’s how much balance is left given an interest rate ..

- you don’t have to trust anybody else to say what the balance is. The math is all there in the contract, and its enforced by shared truth

- At the same time, if somebody mis-writes a contract … that’s going to be interesting.

- Siraj: https://www.youtube.com/watch?v=-_Qs0XdPpw8

- I did some digging around, and I found Monero (XMR)

- Its the not-traceable one. Can’t tell who gave how much to whom —

- you have a secret A, which gives you a receive address B and a view key C.

- Any time you want to get paid, you say “send it to B”

- If you want to see if somebody got paid, you need their view key C to see if they got paid. If you don’t know the view key, you have no idea who paid what to whom or how much.

- Pretty sure folks will use it for illegal purposes.

- Its one of the easiest ones to use, GUI wise.

- You can still mine this for profit with a mid-range CPU.

- So I think it will be pretty stable / get famous (or infamous) / have value.

- Siraj: https://www.youtube.com/watch?v=cjbHqvr4ffo

- There’s a fork of Bitcoin called Bitcoin Cash (BCH) —

- Lots of people owned bitcoin at the fork date ==> they all own bitcoin cash now as well.

- Its much easier to transact than BTC, with much lower transaction fees. Must faster, too.

- It has a good chance of future survival.

- And then I found Iota (IOTA)

- No miners!

- When you want to do a transaction, you volunteer in to doing at least 2 confirmations. So its a .. pay it forward kind of thing. “The more people use it, the faster it gets”.

- Siraj: https://www.youtube.com/watch?v=B37UbzPlSzw

Tools and Services

This is what I’m familiar with so far:

- Coinbase.com — this is how I converted my dollars into cryptocurrency. I have it set up to take about $15 from every paycheck and spread that over BTC and ETH at the moment. I inherited some BCH due to the split, and I did dabble in some LTC but I got rid of it once BCH came around.

- trezor.io – this is a Hardware Wallet that I purchased, and moved most of my BTC and ETH to.

- Sounds fancy. All it is, its… like a flash memory thing. It has some unique numbers stored on it. There’s no way to directly read those numbers off it.. all you can do is log in to it, and say “here sign this thing with those numbers”.

- If it gets damaged or whatever, there’s a list of 24 words to use .. written on paper .. in my safety deposit box … that can be used to reconstruct the unique numbers used. It happens to be that its a “standard” way of doing this, so even if Trezor dies and you can’t get another device like that, there’s several other wallet systems which will accept the 24 words to get back to the secret keys

- The unique numbers are what give you access to the math that’s stored in the blockchain, the “shared ledger” across several hundred thousand computers around the internet.

- binance.com – this is one of many exchanges that exchange value between cryptocurrencies. Use it to quickly convert ETH or BTC to other coins.

Converting ETH to IOTA and XMR

This was a wild ride for me, so here’s a quick summary —

- I signed up for an account. They do email verification.

- I locked my account up using 2FA.

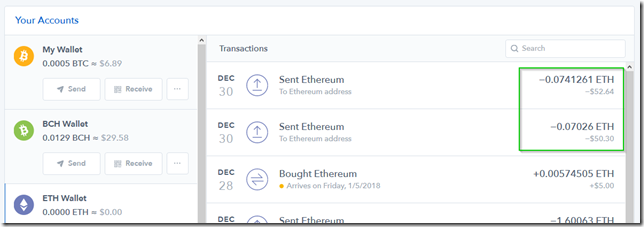

- I deposited ETH (it gave me an address to send the ETH to.. i went to coinbase and sent it). Turns out I had to do it twice, because there’s minimums involved in withdrawing which are around $30 USD equivalent. Here’s what that looked like:

- I went to the ETH/IOTA trading screen and exchanged ETH for IOTA. (Somebody else had IOTA and wanted ETH, the exchange helped us find each other).

- Ditto, ETH/XMR

- The screens for this are crazy with candle graphs and stuff. Made me feel super finance nerdy. There’s also limit and stop limit orders and stuff .. great if you want to day-trade-gamble.

- Once done, I withdrew funds from IOTA and XMR to my IOTA and XMR wallets.

Here’s what that looked like on the Binance side:

Here’s what it looks like in the Monero wallet:

![]() .. as it scans for more transactions involving me.

.. as it scans for more transactions involving me.

Here’s what it looks like in the Iota wallet:

yep, still pending.. there was congestion here, need to wait till other transactions happen which will in turn then verify the above transaction. (the 0 transaction was me clicking “attach to tangle”, which I didn’t understand at the time, but was basically saying “yo say something so that this wallet is established somehow even if nobody gave it money”.)

Whee! So now I have some money locked up in a wierdo thing that only other wierdos would recognize my money in. Ie, I’ve made my money LESS USEFUL! Whee!

Taxes

So, tax season is about here. There used to be doubt, but now its been removed, so this is pretty much how I’m going to do it regarding the US Tax code – although this doesn’t take effect till the 2018 season .. but:

- All transfers into and out of a wallet are short or long term capitals gains, based on the crypto/USD value at the time of the timestamps involved. Regardless if you’re sending it to another wallet that you own or not.

- (there’s some flexibility for which crypto/USD index to use, i’ll find something with an API)

- Coinbase provides a FIFO calculator, which is excellent – they are the bulk of my everything, and the point where my USD happens. I’ll pretty much use that for my taxes, and count transfers to other wallets as short term gains (if applicable). Future lesson is, if something is going to appreciate a lot, PARK IT AT ITS FINAL LOCATION QUICKLY before it starts appreciating to avoid tax penalties.

- I ran some math to figure out how much of a difference things make .. other than making everything short term rather than long term, moving the money to another account in the same currency doesn’t do much on the taxes – the nets are the same.

- At some point, somebody’s going to write some decent tax software to go along with owning crypto currencies .. or they’ll write it for the tax guys so that the tax guys can tell you what you SHOULD have paid. Something like https://bitcoin.tax/ probably.

Okay, that’s about it. The only other thing to throw out there would be, because Bitcoin went up so much, I cashed out enough of it so that even if it (or any of my other coins) went down to $0, I’d still have made money on them, not be in the hole. Good place to leave off the end of the year, I think.

Cheers, laterz.

Oh, I’m running simpleminer.io to mine XMR while I’m using my PC’s. Haven’t gotten any XMR payout yet.