This bitcoin pump cycle caught me off guard. I’m Feeling pretty stupid at the moment; so it is important to process the underlying stuff.

a) Always look at the prices with a scale which starts with 0. Then it would have looked like this:

Instead, what I saw was this, and then I pulled a trigger:

If I backtrack further, the other thing I’d say is: Don’t gamble with money that is “meant” for something else. I really need to pay off one particular credit card. However, the Bitcoin pump came around (i did not know about the halving cycle)… so I put whatever assets I had sitting around (which, mind you, I was NOT paying the CC with, but cushion for toys, more like) in .. and then it became very crucial to NOT DECREASE NOT TAKE A LOSS on that money. Truth be told, I wanted a guaranteed short term return, I was not ready for the long term HODL.

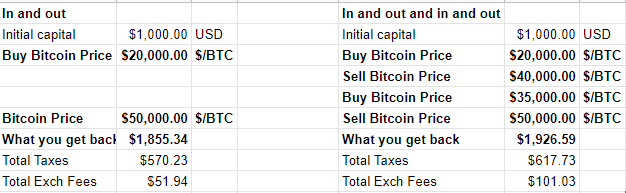

At first I was going to berate myself on “changing my mind” and selling then buying back in at a lower rate (retracement) or sometimes equivalent rate (it rebounded too fast!) because of the extra exchange fees and taxes I might be paying, but then I did the actual math — Looking at it in the long term, as long as all the tax rates are the same (Short term vs Long Term) – Sellng and buying on a retracement can be okay:

I would write something in here about searching for the moving average that looks like it supports the price curve, basically getting a feel of the volatility — then making an internal rule, “I will sell when X dips below Moving Average Y for more than Z time units” – HOWEVER, that’s probably not in line with (a). Maybe it is. Do I really want to buy retracements? I just don’t want to miss the final top. When Do I knows its a final top? I don’t have an answer to that question yet. Maybe its just a “this is good enough” top.

And finally, the FOMO. I KNOW its happening. I don’t want to miss it. I don’t want to be the technical guy who KNEW it was happening AND MISSED it. I don’t want to look incompetent! to my imaginary audience who might be judging me. I judge myself. I judge how much my judge-o-meter is set at. I judge me judging my judge of my judgement.

(LPT: Take a failure, write a blog post about it, then it looks competent)

What is my goal? Financial Independence. Be more willing to take calculated risks rather than just running away and trying to be “safe” and then wonder why nothing happened.